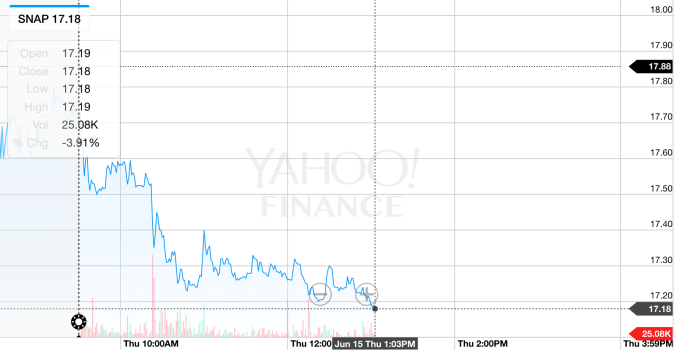

Snap’s last earnings report resulted in a disaster, and while the company still managed to stay above $20 for an extended period of time, a string of bad days for the market — and likely increased skepticism for the company’s future among the rest of the bundle of growth stocks — is putting increased pressure on its price. There have been a slew of smaller IPOs since Snap as more and more companies try to get out the gate, but especially for non-traditional ad-driven companies (looking at Pinterest, for example), it may affect the future of the so-called IPO window being “open.”

We’re going to get another heat check on investor appetite in the next few weeks with Blue Apron, which filed to go public earlier this month. Like Snap, Blue Apron — a meal delivery service that’s as much a consumer service as it is a complex logistical operation — showed a growing business while logging a major loss in the most recent quarter. But Blue Apron also showed it at least has the capability of being profitable, with a $3 million profit in the first quarter last year.

This major decline might not be something that’s wrong on an absolute basis, since $17 is the price that Snap selected as a company going public. But these prices are set to raise as much money as they can while ensuring a “pop” of around 20% or more, making sure investors have an opportunity to lock in some gains. So, for the most part, we can call Snap’s IPO a “success” given its pop, even though the company’s shares have come crashing down to earth. It’s not great for the rest of the people that got into Snap, and it certainly isn’t good for the perception of the company as a potential growth stock like the traditional FANG (Facebook, Amazon, Netflix and Google) bundle.

Full story at TechCrunch

Leave a Comment