Much has changed in the precious metals and mining industry in the past 30 years, as we were all reminded by my longtime friend and mentor Pierre Lassonde. Pierre, as many of you know, is the legendary co-founder, along with Seymour Schulich, of Franco-Nevada, the first publicly-traded gold royalty company. What you may not know is that Pierre is also one of Canada’s most gracious philanthropists and currently serves as the chairman of the Canada Council for the Arts Board of Directors.

According to Pierre, annual global gold demand has exploded in the years since the first DGF was held. Demand grew more than fivefold, from a value of $32 billion in 1989 to $177 billion in 2018.

Loyal readers know that today’s central banks are net buyers of gold as they seek to diversify away from the U.S. dollar. But 30 years ago, they were net sellers. In 1989, banks collectively unwound as much as 432 tonnes from their reserves. Compare that to last year, when they ended up buying some 651.5 tonnes, the largest such purchase since the Nixon administration, with Russia and China leading the way.

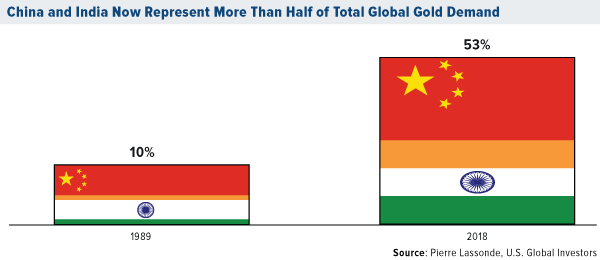

Speaking of China… Pierre pointed out to us that we’ve seen a significant shift in gold demand over the past 30 years, from west to east, as incomes in China and India—or “Chindia”—have risen. In 1989, Chindia’s combined share of global demand for the precious metal was only about 10 percent. Fast forward to today, and it’s 53 percent!

“Don’t forget the Golden Rule,” Pierre said. “He who has the gold makes the rules!”

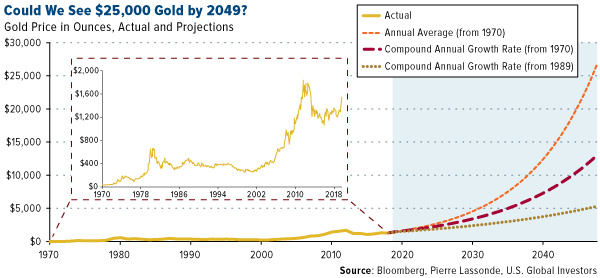

The Gold Price in 2049 Will Be…

One of the highlights of Pierre’s presentation was his forecast for the price of gold in the next 30 years. After analyzing gold’s historical compound annual growth rate (CAGR) over the past 50 years, ever since President Nixon formally took the U.S. off the gold standard, Pierre says he sees an average price target of $12,500 an ounce by 2049. And under the “right” conditions, it could go as high as $25,000!

“I think gold is in a good place,” Pierre told Kitco News’ Daniela Cambone on the sidelines of the DGF. “The financial demand is being driven by negative interest rates. Should the U.S. Treasury 30-year bond yield ever, ever go negative, like in Germany and France, God bless, we’re looking at $5,000 gold.”

Leave a Comment